Refinance Blog

Why should you refinance?

Brought to you by Morgan Financial

Written by Matthew Langdon

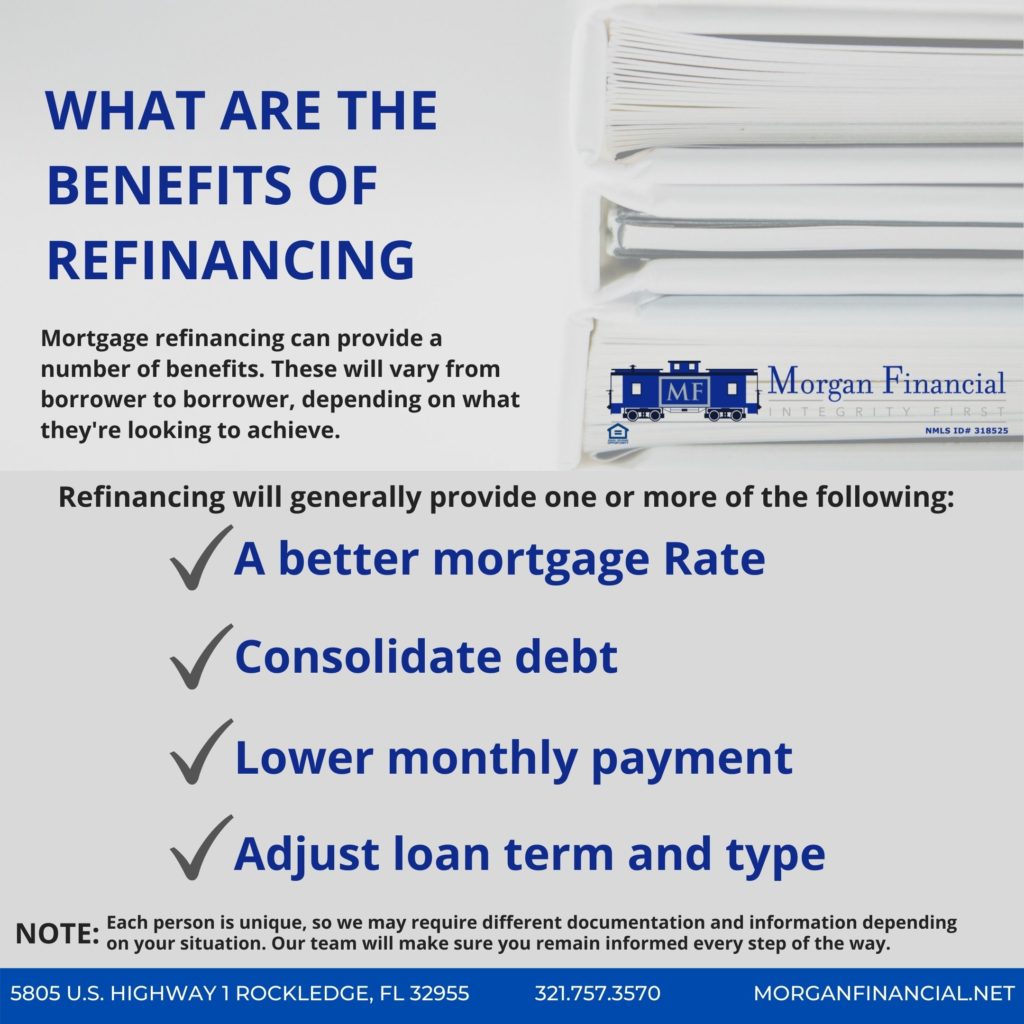

Refinancing is the process of replacing an existing mortgage with a new loan. There are many reasons why someone would choose to refinance their mortgage. In our article today we’ll be discussing some of the reasons why you might want to consider refinancing, what goes into the process, and how we can help as your local lender.

Here are some of the most common reasons why you might want to refinance your home.

Reason #1: Reduce your monthly payment

One of the most popular reasons why many people refinance is to get a lower interest rate on their existing mortgage. Mortgage rates usually fluctuate according to the state of the economy. If rates have fallen from the time when the home was first financed, the difference in monthly cost could be substantial. A lower rate can translate to lower monthly payments, meaning more money in your pocket every month!

Reason #2: Change in loan type

Each loan program comes with its own set of pros and cons. Understanding the loan program you currently have and then reviewing other options could be beneficial for your individual situation. An adjustable-rate mortgage usually has low rates but comes with the unpredictability of payment increases. With a fixed-rate mortgage, you have more stability in your monthly costs. Because interest rates change so often, it might be a good idea to switch to a fixed-rate mortgage when interest rates are low.

Loan Term

Refinancing also offers great advantages if you’re looking to clear up your debt in less time. If you happen to have a 30-year loan that you’re wanting to pay off sooner, you can refinance to a 15-year mortgage. Equity builds faster since you’re paying off the home in a shorter amount of time. Your monthly payments could be higher, but if you’re able to budget for the difference then you could be well on your way towards debt free!

Reason #3: Consolidate your debt

Consolidating your debt through a cash-out refinance involves taking out a new loan to pay off others, then paying off that same loan under more beneficial circumstances. Some of these loans include student loans, car loans, personal loans, medical bills, credit card balances, and other debts. The benefit is that the interest rate on these debts is usually very high, so with a cash-out refinance you can use the equity of your home and pay them off at a much lower interest rate. The most important final step in consolidating your debt is to keep your cards low after the fact. Once your available credit returns, it can be easy to forget that you’re still paying off all of those debts you’ve accrued prior.

Many people who have previously amassed large amounts of high-interest debt on credit cards tend to do it again after refinancing their mortgage. This results in wasted fees from the refinance, lost equity, and additional years of increased interest payments on the new mortgage. On top of that, if you max out your cards again, you’re now shackled with those debts in addition to the consolidated debt. You’ll want to avoid this at all costs.

Reason #4: Converting to Adjustable-Rate or Fixed-Rate Mortgage

There are benefits and disadvantages to both types of mortgages, and your circumstance at the time of buying a home will dictate which is right for you at the time. The great part about refinancing is you can convert your mortgage term if you’re in a better financial situation than when you first got it.Changing your loan program can be a great financial plan depending on a few factors.

Adjustable-rate mortgages usually start out offering lower rates than fixed, but adjustments over time can result in considerable rate increases. The upside is that these monthly payments usually coincide with low-interest rates, which is especially great for homeowners that don’t plan on staying in their homes for more than a few years. While fixed-rate mortgages payments tend to be higher, you have the reliability of knowing rates won’t fluctuate too high.

Find out how we can help you

What is required?

It is important to note that there will be closing costs associated, as well as documentation retrieval similar to what was required for the existing loan.

Although every situation is different and you may have your own specific reasons for refinancing, we would We recommend talking with a mortgage profession to review your current loan rate/terms and your financial goals to discuss if refinancing is right for you.

When interest rates are low, it’s common for a large influx of refinancing applications to come through. Be sure to take time to estimate what your total costs would be for the refinance, what your new monthly payments would look like, and whether or not it’s the right decision for you. There will be closing costs to consider, as well as needed documentation and time. On average, it takes between 20 and 45 days to refinance your home depending on a variety of circumstances. Make sure to follow up with your local lender and request estimated costs to refinance & timeline of how long it may take.

We’re here to help!

Just like taking a loan out on a new purchase, documentation and paperwork will be necessary to make sure you qualify.

We recommend talking with a mortgage professional to review your current loan rate and terms to discuss if refinancing can be a cost benefit for your financial goals. Be sure to take time to estimate what your total costs would be for the refinance, what your new monthly payments would look like, and whether or not it’s the right decision for you.

A common misconception surrounding refinancing is that it is necessary or easier to refinance with whoever is servicing your existing loan. Instead, we recommend taking the time to choose a reputable local lender, as the right lender can make a significant difference in all aspects of the transaction.

If you are considering refinancing or even if you have questions, please feel free to reach out to us here at Morgan Financial for your needs.

We’re still closing deals in record time, and staying in constant communication with our clients, realtor partners, and title companies alike. If you have any mortgage questions or need help, please feel free to reach out to us at 321-757-3570 or submit an application.

(321) 757-3570

5805 US-1, Rockledge, FL 32955

Copyright 2020, Morgan Financial – Disclaimer