Blog

Understanding the Certificate of Eligibility on a VA Loan

If you’re a veteran or active-duty service member looking to buy a home with a VA loan, you need a Certificate of Eligibility (COE) to prove your eligibility. In this guide, Morgan Financial explains what a COE is, why it’s important, and how to obtain one.

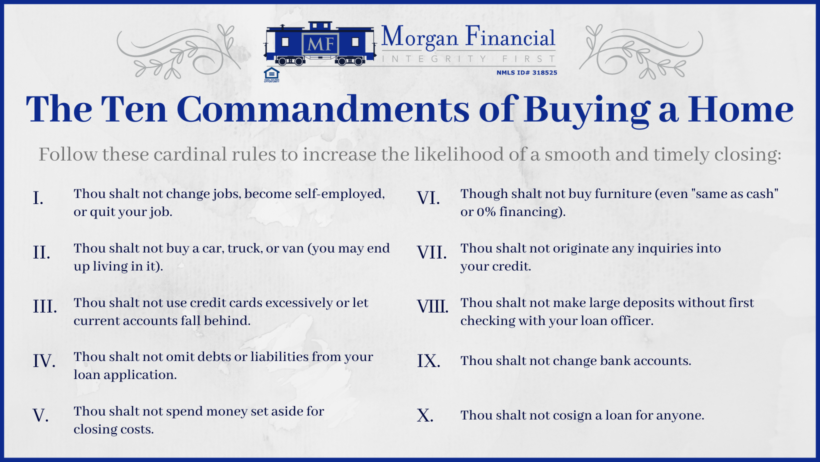

10 Mistakes to Avoid When Buying a Home

There are many important steps to consider when getting ready to buy your home. These are just some of the most common pitfalls you can

When is my first mortgage payment due?

Hello! This is Joe Harris with Morgan Financial and here is your “Joe Knows Mortgages MINUTE.†This week, we answer the question: When is my

What is prepaid interest?

Hello! This is Joe Harris with Morgan Financial and here is your “Joe Knows Mortgages MINUTE.†This week, we answer the question: What is prepaid

When is flood insurance required?

Hello! This is Joe Harris with Morgan Financial and here is your “Joe Knows Mortgages MINUTE.†This week, we answer the question: When is flood

Can I buy a home using cryptocurrency?

Hello! This is Joe Harris with Morgan Financial and here is your “Joe Knows Mortgages MINUTE.†This week, we answer the question: Can I buy

How to Get Rid of Mortgage Insurance – Webinar

What is mortgage insurance? Are you currently paying for it in your monthly mortgage payment? Can you get rid of it altogether? In this video,

How will the Federal Reserve’s interest rate increase affect mortgage rates and home prices?

Hello! This is Joe Harris with Morgan Financial and here is your “Joe Knows Mortgages MINUTE.†This week, we answer the question: How will the

What does the FED’s 75 basis-point rate increase mean for consumers?

Hello! This is Joe Harris with Morgan Financial and here is your “Joe Knows Mortgages MINUTE.†This week, we answer the question: What does the