Blog

Soft Pull vs. Hard Pull on Credit: What You Need to Know

When you’re on the path to securing a mortgage, there’s a lot to consider, and one aspect that often confuses potential homebuyers is the difference

Roles at a Mortgage Lender: Demystifying NMLS and Key Positions

When you’re in the market for a mortgage, you’ll likely come across a myriad of terms and positions within a mortgage lending organization. It’s crucial

Discover Brevard County, Florida’s Premier Fishing and Boating Spots

Are you ready to cast your line or set sail on the crystal blue waters of Florida’s Space Coast? Brevard County, Florida, offers some of

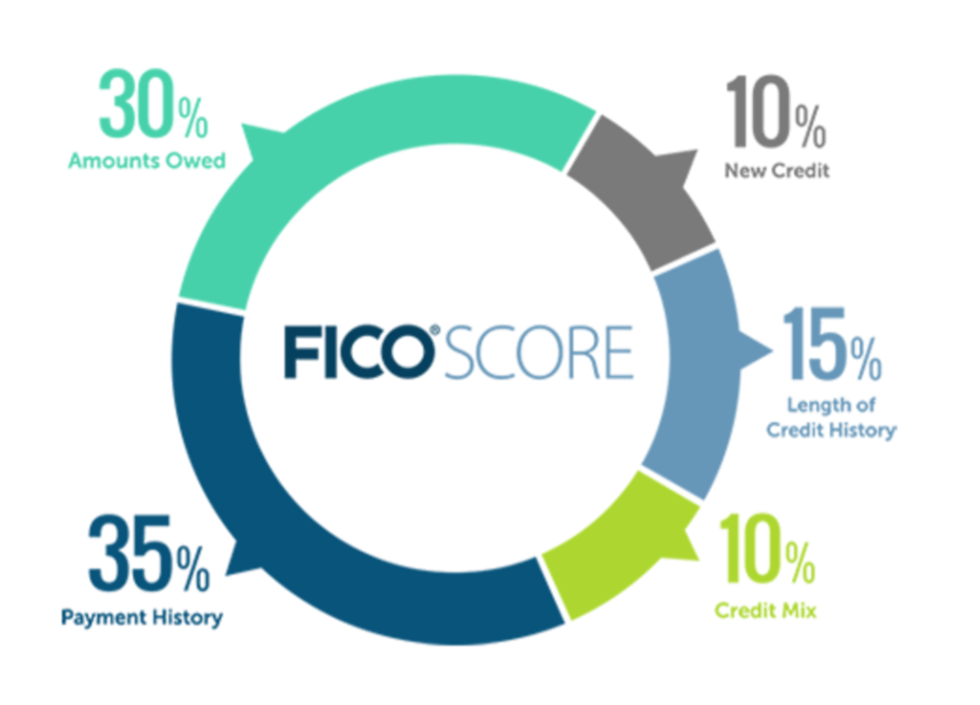

The Impact of Credit Scores on Loan Approvals

When it comes to homeownership, understanding how your credit score influences your ability to secure a mortgage is essential. Your credit score plays a pivotal

How Loan to Value Impacts Your Mortgage Rate: Insights from Morgan Financial, Your Trusted Brevard County Lender

When it comes to securing a mortgage, understanding the impact of Loan to Value (LTV) on your mortgage rate is crucial. LTV is a fundamental

Buy with Little to No Money Down with a VA Loan

Are you a veteran or active-duty service member looking to buy a home in Melbourne, FL with little to no money down? VA loans, offered

Brevard County: Your Next Homebuying Destination

If you’re looking for a place to call home in the Sunshine State, Brevard County, Florida should definitely be on your radar. With its beautiful

Mortgage Pre-Approval is Important

Mortgage Pre-Approval is important if you are a prospective homebuyer in Brevard County? The homebuying process can be challenging, but securing a mortgage pre-approval is

Best Interest Rates on Your VA Loan in Brevard

Are you a military veteran or an active service member seeking a VA loan in Brevard County, Florida? Achieving the best interest rates on your