When you start looking into your mortgage options, inquiries about credit score and personal debt are often the first things to come up in most discussions about purchasing a home. Credit and debt can be a complicated subject, which is why there are a lot of myths and misconceptions floating around out there. We’re here to set the record straight on some of the most common ones:

Myth #1: My credit score is only affected when I miss payments.

Reality: Not so much.

While of course missing payments can drastically affect your credit score, it’s not the only component considered.

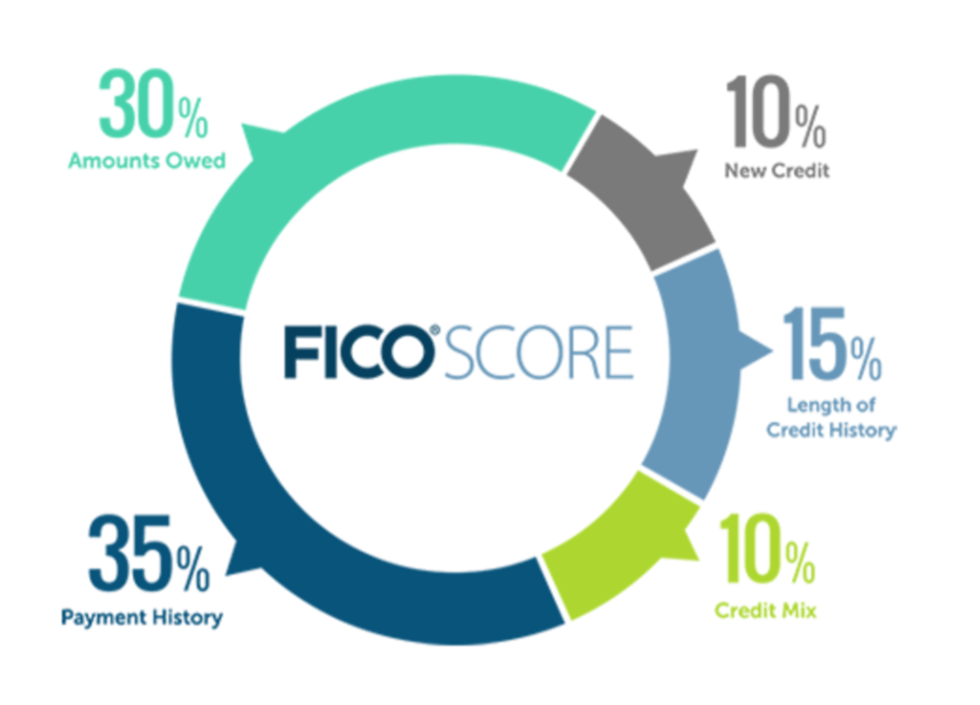

For this example, we will be breaking down your FICO score, which is calculated by the largest and most well-known company when it comes to personal credit score. To break it down very simply, a person’s FICO score consists of 5 different parts: payment history, amounts owed, new credit, length of credit history, and credit mix.

As you can see by the graph above, there are several more factors than just payment history, and each category affects your score differently. You can read a more in-depth breakdown of each part here.

Myth #2: Making minimum payments is a good way to pay off debts while building credit.

Reality: Absolutely false.

In fact, this are probably the worst way to handle debt aside from not paying it off at all. This notion stems from the idea that carrying a small balance on your credit card and only paying the minimum payment somehow helps your credit score.

This is completely untrue. Doing this neither helps nor hurts your credit score, but it will cost you due to the unnecessary interest you are paying. There’s no need to throw away money.

To build credit responsibly, you should be paying off your credit cards on time and in full each month.

Myth #3: You should only have one credit card.

This myth may only apply to those who are irresponsible with their credit cards and either can’t handle having a credit card without accumulating debt or can’t keep track of payments and purchases.

If you are responsible and organized, then you should feel comfortable with getting an additional credit card.

Lenders like to see multiple lines of credit, because it shows that you are able to handle the responsibilities associated with additional credit opportunities.

Takeaway

Credit and debt doesn’t have to be complicated or confusing once you are able to distinguish myth from reality. Knowing the facts keeps those common mortgage myths from holding you back. If you missed part one of our mortgage myth series, you can check it out here to find out what’s fact and what’s fiction when it comes to getting qualified for a mortgage.

If you feel properly educated and are ready to take the next step, give us a call today!