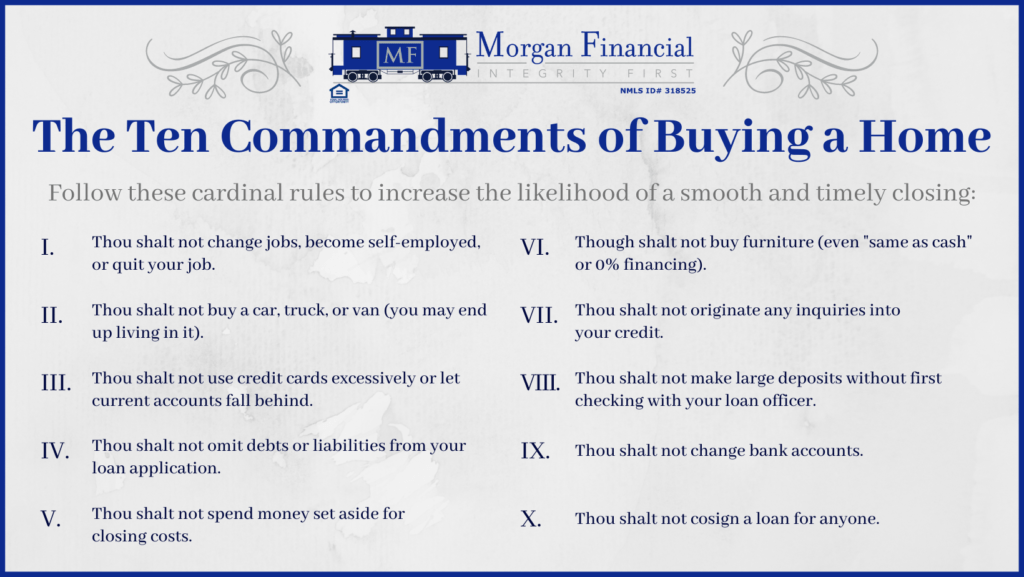

There are many important steps to consider when getting ready to buy your home. These are just some of the most common pitfalls you can get into that can come in the way of you and your new home.

1 – Don’t change jobs, become self-employed, or quit.

Either intentional or unforeseen, changing job status during the mortgage application process can result in your home loan not quite making it to the finish line. If a job change is in your immediate future while applying for a loan, it’s important to inform your lender as soon as possible so they can ensure your loan will be approved. Many lenders will do a final check just before closing to verify your employment status and income. As long as the job you take is in the same industry and is either the same or more pay, then you should still be able to qualify. However, if the new pay structure is too drastic of a change, say for example you currently work as an hourly wage earner and the new position offers a lower salary but with commissions, you may not qualify for the loan due to your debt to income ratio being impacted negatively. You’ll need to discuss with your loan officer to see if you still qualify.

2 – Don’t buy a new car.

Buying a house and a car at the same time is generally considered a bad move since mortgage loans programs can be incredibly stringent at times. Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one of the main ways lenders measure your ability to manage the monthly payments to repay the money you plan to borrow. The first line of defense in a situation where you need a car while applying for a loan would be to simply talk to your loan officer to see if it would affect your chances of the loan. They don’t want you to make any big purchases because it has the potential to increase your DTI ratio, thus pushing you out of the qualifying figures for your loan program. In other words, if you’re set to close on your house this Friday, the safest time to buy your new car would be Saturday.

3 – Don’t excessively use credit cards, or let your accounts fall behind.

It’s typical to have additional expenses while buying a new home however, an important bit of information to note of credit reports is that the credit bureaus report balances at the given point in time they’re pulled. Just because you may have been pre approved, doesn’t mean there won’t be an additional credit check somewhere down the line. Try to avoid opening any additional lines of credit as attempting to do so results in hard inquiries. A hard inquiry indicates to the credit bureaus that you intend on opening an additional line of credit. It could potentially lower your FICO score which could result in not being able to qualify for the loan anymore. Your loan officer may request that you write out an LOE (Letter of Explanation) which explains the purpose of the additional credit. This helps them determine if this stands a chance of affecting your loan.

4 – Don’t spend your money that was set aside for closing costs.

Closing costs are usually one of the bigger worry points that come up in the home buying process, so it’s good to calculate your costs early on and make sure that you have an excess of cash on hand. Some of the most common questions are,

- What if I can’t afford closing costs?

- What is included in closing costs?

- How do I avoid closing costs?

If your closing costs end up being higher than expected, know that you can shop around for many of these services, especially mortgage services to compare rates. Get estimates of origination fees and other charges to help you decide which of several lenders has the best overall cost package. Rates can vary between lenders, so identifying which of them have the best loan programs or guarantees will be helpful in the long run.

5 – Don’t omit debts or liabilities from your loan application.

Generally speaking, you should pay off your major debts before applying for a home loan. Of course this is easier said than done. Most mortgage loan officers will want to know that you have the cash and assets to be able to afford a mortgage before pre approving you for a loan. Per Fannie Mae guidelines, “Lenders need to have processes in place to facilitate borrower disclosure of changes in financial circumstances throughout the origination process.” This means that if there are any undisclosed liabilities, you can expect your lender will have checks in place to ensure that the borrower is financial able to afford a home loan.

6 – Don’t buy new expensive furniture.

Hold off on that $2,600 sectional with fancy cup-holders. Buying new furniture makes sense when you’re about to move into a new home, but not when you need to keep your finances airtight before closing. There are two major reasons why you should avoid big purchases while buying a house. Debt to income ratio, and credit score. You don’t want to open any new lines of credit as this can drop your credit score. Certain things are dependent on your credit score such as your interest rate or even being able to be approved for a loan. The bigger issue is your debt to income ratio. Current government guidelines for the majority of cases say that once you factor in your monthly minimum credit card payments, the minimum payments for any loans you have (cars, student loans, other homes etc.), any other payments you are legally reliable for (alimony, child support, property taxes) and the new mortgage payment, insurance, and taxes needs to be less than your gross monthly income. (All dependent on your loan program!) So if you make 4000 a month before taxes and other payroll deductions, these payments need to be less than 1900 a month. You don’t want to suddenly add 300 dollars a month to your rotating debt because you decided to buy furniture early. They will pull a new credit check before you close since you aren’t closing for several months. If you can get that fridge for cash, go for it. But under any circumstances, do not finance before closing.

7 – Don’t originate any inquiries into your credit.

Anytime you’re looking into opening a new line of credit, you can expect that there will be either a soft or hard inquiry into your credit. A soft inquiry occurs in cases where you check your own credit or when a lender or credit card company checks your credit to pre approve you for an offer. Soft inquiries do not impact your credit scores. A hard inquiry is anytime you’ve applied for a new line of credit. Buying a new car, applying for a mortgage, business loan or a new credit card. Since inquiries (mostly the latter) can affect your credit score, it’s important to keep track of where your credit score stands all the way through to closing.

8 – Don’t make any large deposits without first consulting with your loan officer.

A loan underwriter’s job is to ensure that you qualify for the loan by evaluating your credit history, your ability to repay the loan, and the value of the home compared to the loan amount. They’re also responsible for making sure that your loan follows the rules for the loan type you’re trying to get. If any of these parts come into question, it has the potential to disqualify you for the loan program you’re trying to get. Any large deposits made into your account that can’t be explained or sourced, could cause your lender to question your financial viability as a borrower. If you can’t source the deposit, you can’t use it for your closing costs. Best to verify with your loan officer prior to making any substantial deposits into your account.

9 – Don’t switch banks or bank accounts.

As long as you maintain a steady paper trail, you should be in the clear. However, lenders need to collect quite a few documents most of which are directly associated with your bank.

Pay stubs, tax returns, and bank statements are crucial to the pre approval process which serve to verify the borrower’s ability to afford the loan. If you were to suddenly change jobs or switch banks, your lender may need to delay the pre approval process by as long as a month before they’re able to obtain the most recent documents.

10 – Don’t cosign on a loan for anyone.

General rule of thumb when it comes to this topic. Never cosign a loan that you’re not ready to pay off yourself. When you cosign a loan for someone else, it’s essentially like you’re the one signing the loan. If the borrower defaults, then it falls to you to pay off the remaining balance. It’s a risky gamble, and one that many lenders are not too keen on taking. If you’re trying to apply for a loan, the other party can refinance the loan you cosigned which removes your debt obligation. Say the borrower has been paying off the loan on-time for a good while, there is a great chance that their credit has improved to the point of being eligible to qualify on their own. After refinancing, the original loan will show on your credit report as a satisfied debt, and will not be considered in your debt to income ratio. Since you were listed as the co-borrower, there is a good chance you got a nice bump up in your credit score because the loan shows as satisfied with you as the owner. Car and home loans completed without late payments are positive notes in your credit profile, showing you are responsible and reliable with credit. Even if you weren’t the one making payments, the credit profile doesn’t know that.

Talk With a Mortgage Expert!

Thinking about buying a home? Schedule a time to speak with one of our Mortgage Loan Originators about your homebuying needs and mortgage qualifications! We’ll keep your mortgage on track.