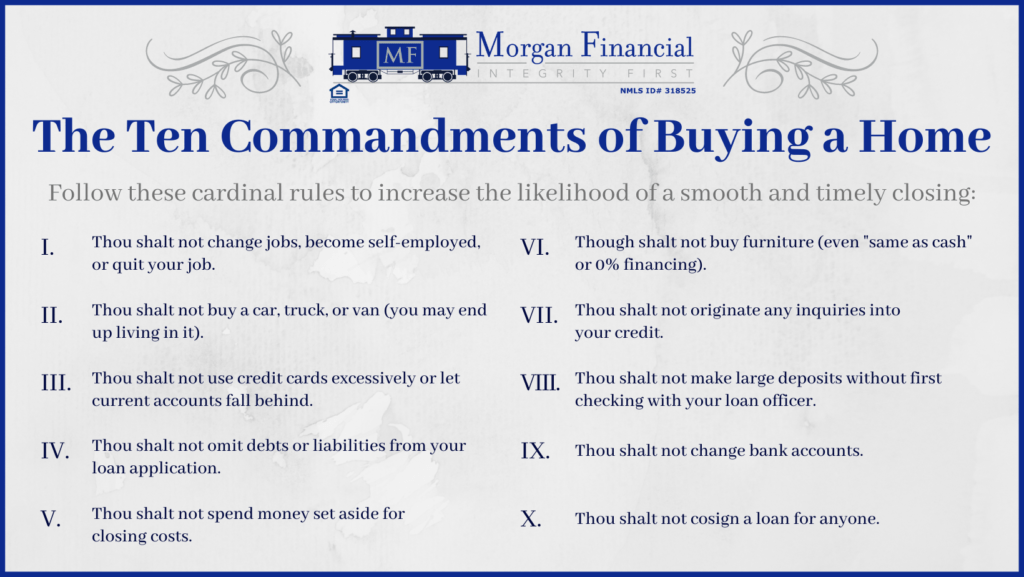

Buying a home is a major milestone, but did you know small financial missteps can throw your mortgage approval off track? Many homebuyers don’t realize how closely lenders monitor their financial behavior before closing. Even if you’ve been pre-approved, these common mistakes could delay your loan—or worse, cause a denial at the last minute!

Here’s what NOT to do when buying a home:

1. Changing Jobs or Income Sources

Lenders verify your employment status multiple times during the home-buying process. If you switch jobs, become self-employed, or move from salary to commission-based pay, you could risk loan approval. Before making any employment changes, talk to your lender!

2. Making Big Purchases (Like a Car 🚗)

Your debt-to-income (DTI) ratio is a critical factor in mortgage approval. Financing a big-ticket item—like a car, furniture, or even appliances—before closing can increase your debt and make you ineligible for the loan. Hold off on big purchases until after closing!

3. Maxing Out Credit Cards 💳

Lenders keep an eye on your credit score throughout the home-buying process. Running up credit card balances or missing payments can lower your score and increase your DTI, making you a riskier borrower. Keep credit usage low and always pay bills on time.

4. Spending Your Closing Cost Funds 💸

Your lender will verify that you have enough funds for closing costs. Dipping into that money before closing can lead to delays—or worse, loan denial. Have a solid budget in place and keep those funds untouched until the deal is sealed!

5. Hiding Debt or Financial Obligations

Some buyers think they can leave out debts on their mortgage application to improve their chances. Don’t do it! Lenders conduct thorough financial checks, and any undisclosed debts can cause major problems during underwriting. Full transparency is the best approach!

6. Financing New Furniture 🛋️

It’s tempting to buy new furniture before move-in day, but if you finance it, you’re adding more debt—which can hurt your credit and affect your mortgage approval. If you can’t pay cash, wait until after closing to make any big purchases.

7. Applying for New Credit 🏦

Even opening a store credit card for a small purchase can trigger a hard inquiry, which can lower your credit score. Lenders don’t like to see new accounts during the mortgage process. Avoid new credit applications until after you close on your home!

8. Making Large Deposits Without Documentation

If you deposit a large sum of money into your account, lenders will need to verify the source. Unexplained cash deposits can raise red flags. If you receive a gift or transfer funds, make sure you have proper documentation ready to provide to your lender.

9. Switching Banks 🏦

Lenders need consistent financial records to approve your loan. Changing banks mid-process can cause delays in verifying your financial history. If you must switch accounts, talk to your lender first!

10. Cosigning a Loan for Someone Else 🤝

When you cosign a loan, that debt appears on your credit report as if it were your own. Even if the primary borrower makes all the payments, lenders count that debt against you when evaluating your mortgage application. Wait until after closing before cosigning any loans.

Bottom Line:

The key to a smooth home-buying experience is financial stability. Avoid making any major financial changes until after closing day. If you’re unsure about a financial decision, always check with your lender first!

💡 Ready to start your home-buying journey? Contact Morgan Financial today for expert guidance and mortgage solutions tailored to your needs!