When it comes to homeownership, understanding how your credit score influences your ability to secure a mortgage is essential. Your credit score plays a pivotal role in the loan application process. In this blog post, we’ll dive into the mechanics of credit scores and their impact on your eligibility for a loan in Brevard County.

The Significance of Credit Scores

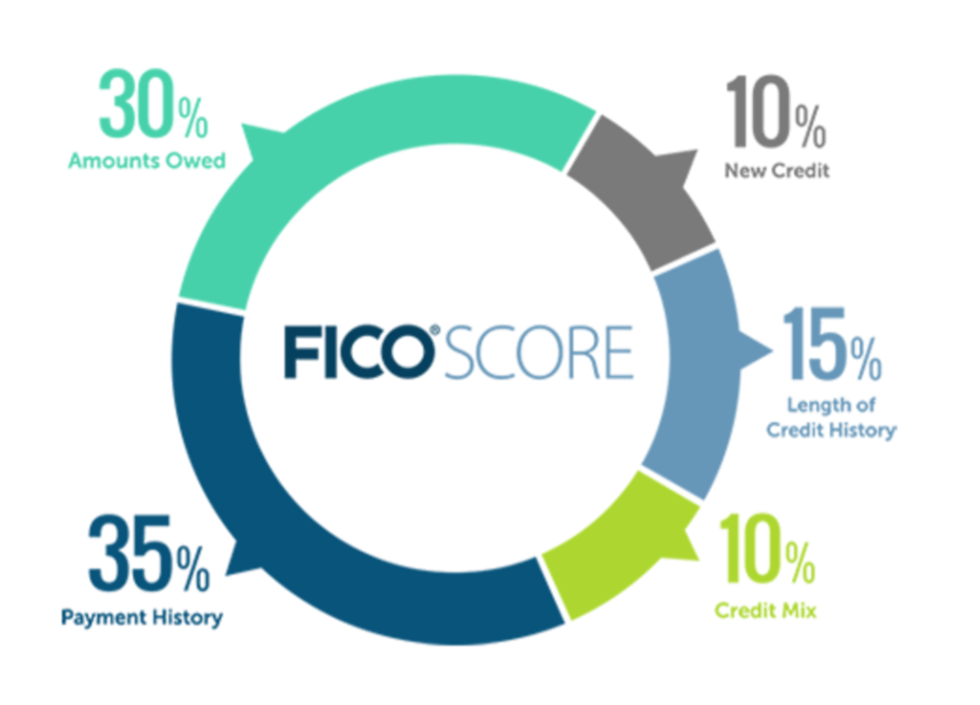

Your credit score is a numerical representation of your creditworthiness. It provides lenders with a quick snapshot of your financial responsibility and the risk associated with lending to you. The higher your credit score, the more appealing you are to lenders, as it suggests responsible financial habits.

A strong credit score often leads to more favorable loan terms, such as lower interest rates, reduced monthly payments, and better loan conditions. Conversely, a lower credit score may result in higher interest rates and less advantageous loan terms. In short, your credit score can significantly influence not only your loan approval but also the overall cost of borrowing.

Enhancing Your Credit Score

Improving your credit score is a proactive step you can take to enhance your chances of securing a loan with favorable terms. Here are some strategies to consider:

1. Review Your Credit Report: Obtain a copy of your credit report and scrutinize it for errors or discrepancies. Correcting any inaccuracies can help boost your score.

2. Pay Bills on Time: Consistently paying your bills and debts on time is a key factor in maintaining a high credit score.

3. Reduce Credit Card Balances: High credit card balances relative to your credit limit can negatively impact your score. Aim to lower your credit card balances.

4. Avoid Opening New Credit Accounts:Â Multiple new credit inquiries can temporarily lower your score. Be cautious about opening new accounts before applying for a mortgage.

The Role of Local Lenders

Local lenders in Brevard County, like Morgan Financial, possess a deep understanding of the local real estate market. They can offer personalized advice and support tailored to your specific circumstances.

While local lenders may not directly assist with credit score improvement, their expertise in the local market can be valuable when selecting the right mortgage option.

Empower Yourself with Knowledge

Understanding how your credit score affects loan approvals is the first step towards achieving your dream of homeownership, whether you are purchasing alone or with a co-borrower like your spouse. By working to improve your credit score and exploring the expertise of local lenders, you can navigate the complexities of the loan application process with confidence.

Talk With a Mortgage Expert!

Remember, the journey to homeownership may be challenging, but with the right knowledge and efforts, you can enhance your financial standing and secure the loan you need for your future home.